Cross-border commerce is growing fast, but many payment pages aren’t built for international buyers. Just one small friction – like an unfamiliar payment option or unclear pricing – can lead to cart abandonment. Localizing the payment experience removes these obstacles and helps turn global interest into real revenue. Here is the way we can use to localize payments.

Localize payments overview

Payment localization refers to adapting the payment experience to match user habits and specific conditions of local markets.

Example: A US-based shoe company looking to attract customers in Vietnam needs to offer locally preferred payment methods such as QR code bank transfers or e-wallets like MoMo, instead of relying solely on credit/debit card options that work well with US customers.

Business benefits of payment localization

> Reduce cart abandonment by offering familiar payment options

> Increase conversion rates through a checkout experience that feels local and intuitive

> Build trust and credibility with customers in the target market

> Tap into the booming cross-border e-commerce wave – expected to reach $7.9 trillion by 2030 (Statista)

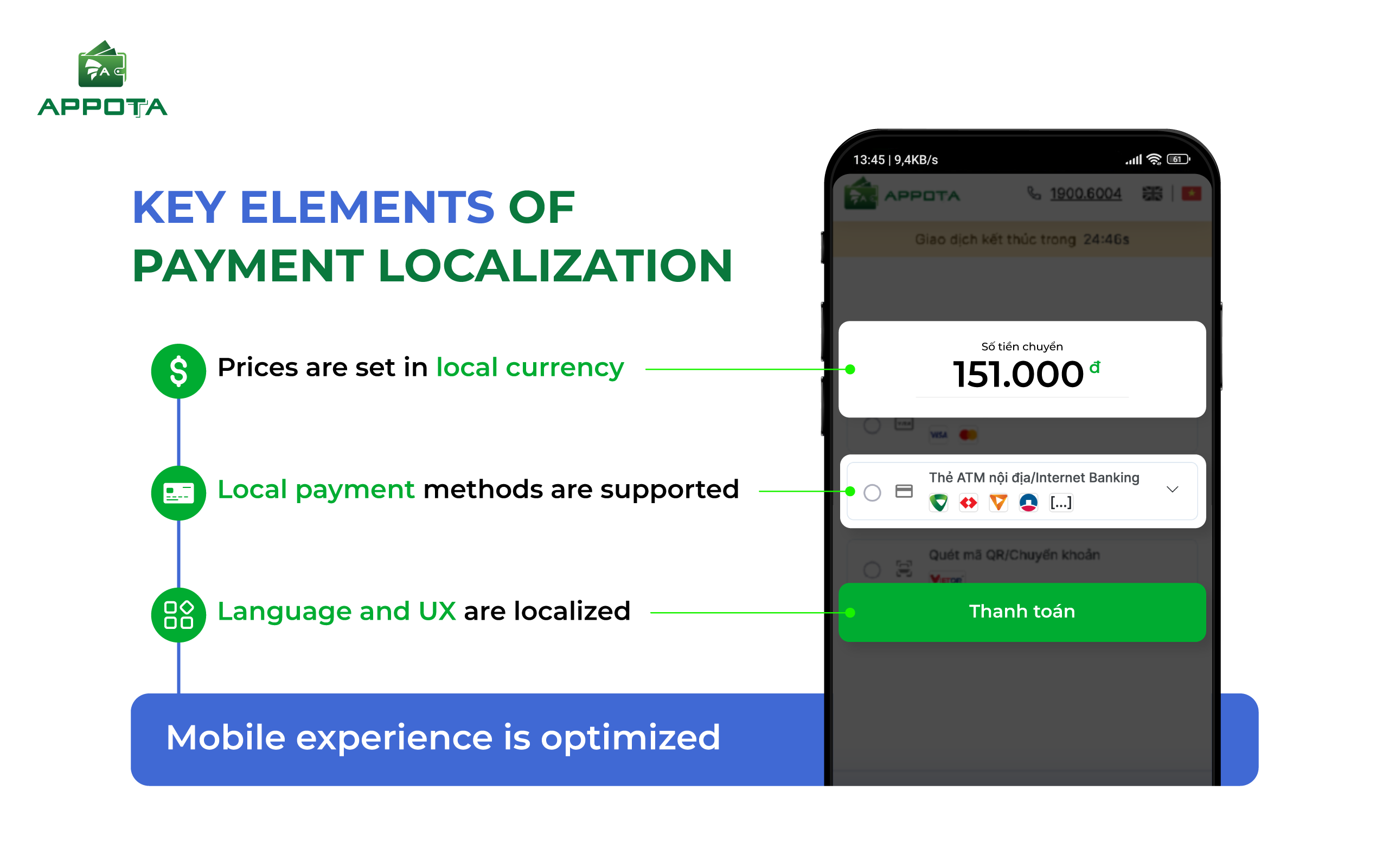

Key elements of payment localization

When optimizing payment experiences for global users, not all elements are equally impactful. Below are the ones with the greatest influence on conversion:

> Local payment methods: Customers may abandon their purchase if they don’t see a familiar option. For example, iDEAL in the Netherlands or WeChat Pay and Alipay in China are must-haves in those respective markets.

> Local currency display: If users have to manually convert currencies, it creates confusion and concerns about hidden fees. Showing prices in local currency offers clarity and reassurance during checkout.

> Localized checkout experience: Poor translations on the payment page can signal unprofessionalism and shake customer confidence – especially when sensitive information like bank details is required.

> Mobile checkout optimization: With the growing trend of shopping on mobile devices, checkout interfaces must be simple and easy to use on small screens.

How to localize payments in 3 steps

> Step 1: Analyze existing data

Start with real-world data. Where are users coming from? Which markets have high traffic but low checkout completion? These signals can help prioritize where to localize first.

> Step 2: Select target markets

Focus on markets with high demand but low conversion. Consider implementation difficulty – some regions only require currency adjustments and local payment options, while others may need complex legal and system integrations.

> Step 3: Roll out gradually

Start with broad updates like enabling global payment methods, mobile optimization, and translating interfaces into widely spoken languages. Then move into market-specific adjustments to maximize impact.

>> See more: Vietnam’s Banking Sandbox: How Decree 94 Opens a Smarter Path for Fintech Testing

Key considerations for payment localization

To ensure effective implementation, businesses should keep in mind:

> Focus on one market at a time: Allows for better cost control, execution, and performance tracking.

> Ensure payment security: Use tools like 3D Secure or OTP to protect users and minimize fraud.

> Comply with local regulations: Every market has its own rules around data, tax, and payments – understand and follow them closely.

> Collaborate with local partners: Work with experienced local providers to reduce risk and shorten the launch timeline.

> Continue monitoring post-launch: Localization is not a one-time task – it requires ongoing tracking and updates to maintain a high-quality user experience.

Conclusion

Localize payments isn’t just about improving the user experience. It’s a strategic lever for global business growth.

As one of Vietnam’s leading payment intermediaries, AppotaPay offers a comprehensive cross-border payment solution that helps international businesses:

> Quickly integrate with popular Vietnamese payment methods such as bank transfers, e-wallets, and QR codes

> Display product prices in local currency for transparency and familiarity

> Ensure full legal compliance and risk management without building custom systems

> Offer a Vietnamese-language payment interface to enhance user experience and boost conversions

> Save time and costs through ready-to-use infrastructure and support from local experts

Looking to expand your market and unlock new revenue?

Take the first step – contact AppotaPay for a consultation!

Bài viết liên quan

Bài viết liên quan

Sẵn sàng để bắt đầu?

Hưởng chiết khấu hấp dẫn dành riêng cho các đối tác

của AppotaPay!

Thanh toán toàn diện - Kết nối thuận tiện

Trải nghiệm giải pháp công nghệ số mới nhất từ AppotaPay.

Liên hệ

Trụ sở chính: Tòa nhà số 15+17, Ngõ 81, Phố Láng Hạ, Phường Ô Chợ Dừa, Thành phố Hà Nội, Việt Nam

Chi nhánh: Tầng 4, Tòa nhà TF, số 408 Điện Biên Phủ, Phường Vườn Lài, Thành phố Hồ Chí Minh, Việt Nam

Tổng đài hỗ trợ tư vấn: 19006004

Liên hệ kinh doanh: (+84) 907788363

DỊCH VỤ

Trải nghiệm

Đã được cấp giấy phép hoạt động cung ứng dịch vụ trung gian thanh toán số 74/GP-NHNN của Ngân hàng nhà nước Việt Nam vào 08/10/2020.

Thanh toán toàn diện - Kết nối thuận tiện

Trải nghiệm giải pháp công nghệ số mới nhất từ AppotaPay.

Liên hệ

Trụ sở chính: Tòa nhà số 15+17, Ngõ 81, Phố Láng Hạ, Phường Ô Chợ Dừa, Thành phố Hà Nội, Việt Nam

Chi nhánh: Tầng 4, Tòa nhà TF, số 408 Điện Biên Phủ, Phường Vườn Lài, Thành phố Hồ Chí Minh, Việt Nam

Tổng đài hỗ trợ tư vấn: 19006004

Liên hệ kinh doanh: (+84) 907788363

DỊCH VỤ

Đã được cấp giấy phép hoạt động cung ứng dịch vụ trung gian thanh toán số 74/GP-NHNN của Ngân hàng nhà nước Việt Nam vào 08/10/2020.